“Rollups get cheaper with more users”. You’ve probably read a phrase like this about how rollups are fundamentally different from other blockchains because they flip the traditional blockchain cost structure on its head. While it is true that rollups can provide cheaper fees for users despite increasing transaction activity, there’s more to the story.

The costs

Rollups submit groups of blocks in a batch to a separate blockchain, known as our base layer. The cost of producing and submitting a batch to the base layer is comprised of six key variables.

- Fixed costs: Costs of submitting a batch to the base layer with zero transaction activity on the rollup (state commitment, plus a validity proof for zk-rollups).

- Variable costs: Costs that vary with the level of transaction activity on the rollup (transaction data, plus signatures for optimistic rollups).

- Average variable cost: The variable cost of each additional rollup transaction.

- Total cost: The total cost of publishing the batch to the base layer.

- Marginal cost: The cost (fixed + variable) of each additional rollup transaction.

- Average cost: Fee the individual user pays.

The phrase “Rollups get cheaper with more users” is correct when the average cost decreases while increasing the number of transactions per batch.

average cost = total cost / number of transactions per batch

This occurs because the marginal cost of submitting an additional transaction in the rollup batch is less than the average cost per transaction. Let’s assume a rollup batch with 500 transactions and an average cost of $1 per transaction, bringing the total cost to $500. If the marginal cost of an additional transaction is $0.70, then the same batch with 501 transactions becomes $500.70. Therefore, the average cost is reduced to $0.9994. Note that the marginal cost is made up of only variable costs, primarily transaction data, as fixed costs are amortized over the entire batch and get paid regardless.

The phenomenon of cheaper fees while increasing activity is in stark contrast to monolithic blockchains that only incur negative network effects – fees increase with each additional user. Rollups shift the paradigm as they are the first type of blockchain that can incur positive network effects with regards to transaction fees – data availability layers that implement data availability sampling also fall into this category for scalability.

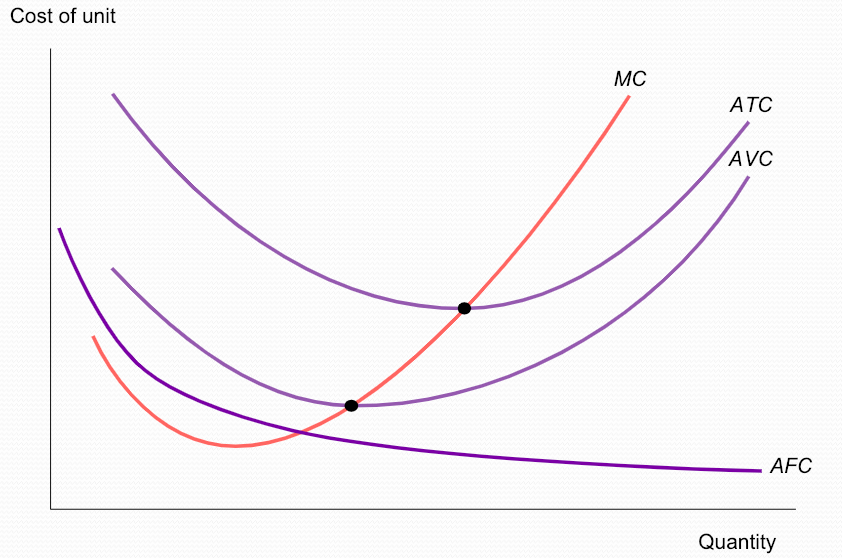

However, this paradigm breaks once the marginal cost of including an additional transaction is equal to the average cost. The cost curve of a rollup will approximately follow that of the standard short-run cost curve. The point at which positive network effects occur is during the first “half” of the curve, where the marginal cost curve is below the average variable cost and average cost curves (marked AVC and ATC respectively).

Let’s assume another rollup batch with the same initial variables of 500 transactions per batch, an average cost of $1, and a total cost of $500. If the marginal cost of an additional transaction is $1.10, then the total cost for 501 transactions becomes $501.10. Therefore, the average cost increases to $1.002.

Once the marginal cost curve exceeds both the average variable cost (AVC) and average costs (ATC) curves, intersecting the minimum of each curve, the rollup enters the same negative network effects as monolithic blockchains, where each additional transaction increases fees. The primary contributor to rising rollup costs is transaction data due to it being the largest variable cost, which influenced the emergence of hybrid rollups, such as validiums and volitions, to seek cheaper average costs by utilizing off-chain data availability.

Since transaction data costs are tied to that of the base layer, which has finite block space, the rollup is also susceptible to fee spikes that originate on the base layer – this is problematic for base layers that have an ecosystem of user-facing applications on them. Base layer fee spikes occur when each additional transaction causes an exponential increase in fees (demand > supply). The consistency of such situations is primarily determined by the volatility of the base layer’s fee market and the frequency with which demand exceeds supply for block space.

To mitigate the frequency of fee spikes affecting the rollup, base layers need to focus on increasing data throughput as transaction data is the largest variable cost for rollups. Increasing data throughput enables the rollup to maintain positive network effects at greater capacities due to cheaper variable costs, while also enjoying additional throughput gains. To enable this, scalable data availability layers will be fundamental in making rollups inexpensive for users without sacrificing security and decentralization.